By Bernard Markstein, Ph.D.

A look at the latest economic and employment trends … and how you as plumbing and HVACR contractors can use them to identify where growth will occur and possibly shift your strategies.

As plumbing and HVACR contractors face a host of both business challenges and opportunities this year, strategic planning and adaptability will be key factors in your company achieving success. With this report, PHCC is helping to equip you with the latest economic and employment trends and – more importantly – areas where you may want to concentrate your business efforts moving forward.

The Economy and the Federal Reserve

The U.S. economy proved stronger and more resilient than expected in 2023. Based on numbers available at the end of January, gross domestic product (GDP) was up 3.1% from fourth quarter 2022 to fourth quarter 2023. Notwithstanding the strong performance of the economy, inflation fell from a pandemic peak of 9.1% in June 2022 to 3.4% in December 2023 as measured by the consumer price index (CPI).

While Chair Jerome Powell of the Federal Reserve is pleased that the inflation rate has fallen, he has stated that the Fed wants to be sure that inflation is on a solid trajectory to stabilize around the Fed’s 2% target. Thus, no reduction in interest rates will occur prior to May, and more than likely not until later in the year. When the Fed does begin to lower interest rates, it will do so slowly in 0.25% increments.

Employment

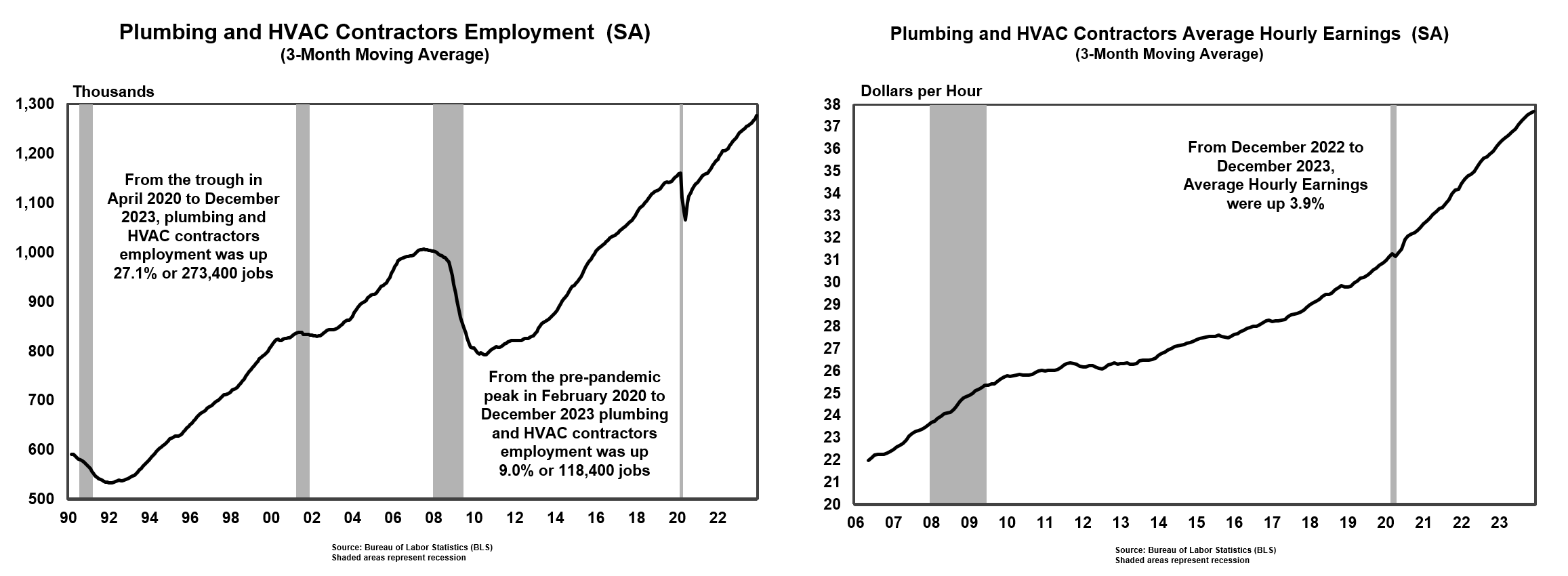

Employment also has proved to be more robust than anticipated. In January 2024, the national unemployment rate stood at 3.7%, close to its pandemic low of 3.4% in January and April 2023.

As of December 2023, plumbing and HVAC contractors had 1.28 million jobs, 10% above its pre-pandemic peak in February 2020. Further, average hourly earnings increased from its February 2020 pre-pandemic peak of $31.33 an hour to $37.73 in December 2023, an increase of 20%.

Opportunities for Plumbing and HVACR Contractors

Despite high interest rates, which create headwinds for the construction industry, there are opportunities for plumbing and HVACR contractors. For example, the Inflation Reduction Act of 2022 provides tax credits for homeowners, commercial building owners, and homebuilders who install certain energy-efficient hot water heaters and HVAC systems. Working with any of these groups, plumbing and HVACR contractors can encourage the installation of qualified energy-efficient appliances and systems that benefit from reduced cost of installation (due to the tax credit) and ongoing cost reduction from lower energy bills as a result of the more energy-efficient equipment. Some local utilities offer rebates on some of this equipment as well. Some states and localities offer energy assistance programs to upgrade heating systems for low-income households.

Residential Construction

The housing market in particular has felt the effects of higher interest rates. Homeowners have been reluctant to sell their houses, since in most cases they would be giving up an ultra-low mortgage rate, limiting the supply of existing homes for sale.

Homebuilders have been faced with higher input costs (both for labor and building materials) as well as high interest rates. They have adjusted to these challenges by building more smaller, affordable homes. To attract homebuyers, they often have offered incentives such as free upgrades or buying down the mortgage rate of purchasers for the first few years of their mortgage.

There are two opportunities for p-h-c contractors: first, installing plumbing fixtures and HVAC systems in new houses, and second, upgrading/replacing old plumbing and HVAC systems in existing homes as homeowners decide to keep their current home and instead improve it.

Meanwhile, there has been a slowdown in multifamily construction activity that will extend into the first part of next year. Nonetheless, construction of multifamily buildings will continue at a healthy level, though not at the pace seen in recent years. There will still be plenty of work for plumbing and HVAC contractors on the new projects.

Office Construction

The demand for office space has been adversely affected by fallout from the pandemic. The acceptance of many companies of remote work and the rise of the hybrid model that incorporates a mix of in-office and remote work has reduced demand for office space.

In 2024 and 2025, there will be few new large projects. There will be some limited demand for renovation of existing space. Most new office construction will be smaller projects in the suburbs and in the South and Southwest. This may prove to be an opportunity for plumbing and heating contractors as there will be many small projects requiring the installation of plumbing and HVAC systems rather than large systems in big office buildings.

Beyond that, existing office buildings still require normal inspection and maintenance of their HVAC and plumbing systems.

Retail Construction

Retail construction activity has slowed considerably and will be even slower this year and next. One opportunity is new bars and restaurants, which have been proliferating, frequently taking over existing space from previous shuttered food service establishments. In many of these cases, major renovations are needed, requiring HVAC systems that incorporate good ventilation and filters. Further, there is the need for touchless plumbing fixtures in both the bathrooms and the kitchen.

Another development is online commercial sites opening brick-and-mortar stores, requiring HVAC and plumbing systems. There is some opportunity for installing HVAC systems in both self-storage buildings and warehouses that provide a climate-controlled environment.

Lodging Construction

Leisure travel has more than recovered, while business travel is slowly improving. With consolidation in the industry, few new hotels and motels are being built. Most of the spending over the next two years will be focused on repair and maintenance and renovation at the few places that have not updated their facilities in the past few years.

Education Construction

Some schools have already updated their HVAC systems to deal with coronavirus-related health concerns. However, other schools (mainly, but not exclusively, urban schools) still need to install or upgrade their HVAC systems to improve air flow and reduce the risk of spreading transmissible diseases. Also, touchless plumbing fixtures need to be installed in bathrooms and kitchens in many of these schools.

The Infrastructure Investment and Jobs Act passed in November 2021 provides $200 million over five years for secondary schools for clean drinking water, with a particular focus on replacing lead pipes. Another $500 million is available for secondary schools and non-profits to improve energy efficiency, which includes improving HVAC systems. Most of these funds will be flowing out to school districts in 2024 and 2025.

New construction of educational facilities will only slowly increase in 2024 and beyond. Recent increases in labor, building materials costs, and borrowing costs due to higher interest rates have led some school districts to scale back their plans or shelve planned projects for a future time.

Healthcare Construction

The complexity and cost of building large healthcare centers (hospitals) has been a hinderance to new construction of these facilities. The difficulty in properly staffing existing facilities has added to the reluctance to pursue these projects, or at least to slow the planning and execution of new construction. Urgent Care facilities and other small healthcare facilities are where most of the activity will be this year and next. These facilities will require up-to-date plumbing and HVACR systems.

Funding and construction of new facilities will grow slowly over 2024 and 2025, and beyond.

Building Conversions

Another area to investigate is conversion of existing buildings to other uses. There are relatively few of these projects due to their complexity and cost, but for those that do occur, they are a great opportunity for plumbing and HVACR contractors for upgrading/installing plumbing and HVAC systems.

Two types of conversions:

• Hotel and retail space to office space.

• Hotel, office, and retail space (especially malls) to residential space.

The most interest (and funding) is in the conversion to residential space. Various cities are actively promoting (often with grants and/or tax incentives) or are exploring ways to promote these projects. Some cities are also promoting converting hotels to multifamily units aimed at housing the homeless or providing more affordable housing. Often mall conversions encompass residential, retail, and hotel space, all of which need installation of plumbing and HVAC systems.

President and Chief Economist