By Bernard Markstein, Ph.D.

The economy is moving upward, albeit at a slower rate of growth. How will you respond to continuing issues … and new opportunities?

Even as COVID-19 and its variants remain in charge of the economy, people are adapting, resulting in a shorter and less severe disruption to the economy with each new wave. Overall, the economy has been and continues on an upward trajectory, though the rate of growth will slow in 2022 and 2023.

The travel and hospitality industries were hit hard by the pandemic. They have started to recover in fits and starts. They are adapting to the new reality, but it will take a few years to recover to pre-pandemic levels.

Meanwhile, there has been a redistribution of the population. The availability of remote work has permitted some workers to move to less expensive areas. Many of these moves were from the denser part of urban areas to suburbs of those same cities. Others moved to smaller, less expensive areas of the country. The return to the office of old is turning out to be a slow process (often delayed), with central business districts and businesses that were supporting workers in those areas in pre-pandemic times suffering the most.

When will employment levels return to normal?

After taking a huge hit at the beginning of the pandemic, employment has been in recovery mode. Nonfarm payroll employment has increased every month since the end or the recession in April 2020, with only one exception (December 2020), sometimes with huge increases. Nonetheless, employment remains below its pre-pandemic peak in February 2020. Seasonally adjusted (SA), nonfarm payroll employment peaked at a little more than 152.5 million jobs, while SA construction employment peaked at more than 7.6 million jobs.

As of December 2021, nonfarm payroll employment was 2.2% below its pre-COVID peak; construction employment was 1.3% below its peak. Meanwhile, the unemployment rate stood at 3.9%.

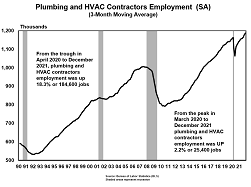

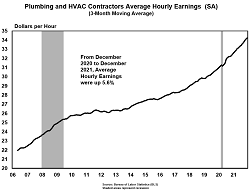

Plumbing and HVAC contractors employment ended up taking a different path. Employment for this sector peaked pre-pandemic in February 2020 at 1.17 million jobs. After an initial drop in March and April of 2020, it began to recover. By a year and a half later, in August 2021, employment exceeded its pre-pandemic peak. As of December 2021, the sector had 1.19 million jobs, 2.2% above its pre-pandemic peak. Further, average hourly earnings increased from its February 2020 pre-pandemic peak of $31.35 an hour to $34.35 in December 2021, a jump of 9.6%.

Construction on the Rebound

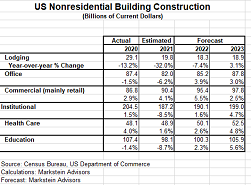

Construction has felt the effects of the pandemic. The pandemic has exacerbated the shortage of skilled labor in construction, was a prime factor in disrupting the supply chain and driving building materials prices higher, and led to a shift in underlying demand. Residential construction surged, while office, lodging and education construction declined. Total construction spending rose in 2021, lifted by residential construction activity. Current dollar construction spending rose 8.2%, mainly due to higher labor and building materials costs.

Supply chain issues will improve throughout the year but not be completely eliminated. Some building materials prices will fall, but many will remain elevated as manufacturers hold the line to regain their profit margins. In general, basic materials such as steel and copper that are sourced from several areas are likely to fall in price as producers ramp up production. The administration’s recent removal of a 25% tariff on Japanese steel is a positive sign and may signal a willingness to remove or lower tariffs on other building materials. Finished products with fewer competitors are likely to hold the line on pricing and raise their prices when they can.

At least for the first half of the year, and possibly the whole year, expect continued delays in delivery of products. Thus, when feasible, it will be wise to order earlier than usual and be willing to hold needed products for future projects in inventory. It also would be beneficial to seek out alternative sources for needed products and to consider alternatives to replace those products that are not readily available. Major outbreaks of new variants of the coronavirus would further disrupt the supply chain and exacerbate delivery problems and push prices up further.

Residential construction will again be the top performer, followed closely by health care construction. Education construction spending will be slow in 2022 but increase in 2023. Retail and office construction activity will be slow. Lodging construction will see further retrenchment in 2022 before turning slightly positive in 2023.

Residential Construction

The rise in remote work and remote learning were key forces driving the desire for more and better residential space. Remote work allowed people to move further from center city locations to suburban locations or even to other, smaller cities. With housing prices and rental rates lower in most of these locations compared to where people were moving from, many of these people were able to afford the larger houses or bigger apartments they desired.

However, the increased demand and the ability to pay top dollar, along with low interest rates, drove housing prices and rents higher in many of these locations. Nationally, single-family housing prices were up almost 20% for the year, with some communities seeing prices rise in excess of 30%. Higher building materials prices, supply chain issues, and increased labor costs pushed new construction costs up. These factors limited the ability of builders to build single-family houses. Although also hampered by these same factors, multifamily projects were able to take up much of the slack.

Rising but still historically low interest rates along with high housing prices will act as a curb on demand this year and next, limiting future price increases. At the same time, the need/desire for more space remains, bolstering housing demand. Skilled labor shortages and – although improving – continued supply chain issues, as well as high building materials prices, will limit single-family new construction. Multifamily construction will moderate slightly but remain strong overall. Spending on improvements will continue at a healthy, but somewhat slower, rate this year, with further slowing (but still positive) growth next year as current owners who would like to move but can’t afford to do so instead make improvements to their existing homes. Spending in all of these arenas will benefit plumbing contractors.

As was the case in 2021, both existing and new multifamily buildings will demand HVAC systems that provide significant outside air exchange that filters out pollutants and pathogens. These systems need to be easy to monitor to maintain peak performance and have filters that are easy to clean or replace. Plumbing fixtures utilizing touchless technology will be a basic requirement for shared bathrooms and other common areas (e.g., shared kitchens). Some projects will incorporate desirable features like fountains and swimming pools.

Office Construction

The office market is still in flux. Some companies want their workers back in the office as soon as possible, but the coronavirus has upset their plans for a return several times. Many companies will continue to incorporate some remote work but also maintain a central office. The hybrid model – incorporating a mix of in-office and remote work – is emerging as a popular choice for many firms. Shared office space is also becoming popular among a number of companies. This approach reduces the footprint for individual workers in the office (a trend that was occurring before the pandemic) but is at least partially offset by increasing the distance between employees at work and increasing the space in meeting rooms.

For existing office buildings that haven’t already done so, they need to upgrade their HVAC systems with high-quality ventilation that incorporates considerable outside air exchange and captures pollutants and pathogens. These systems need to be easy to care for with low-cost maintenance. Plumbing fixtures with touchless technology is another necessity; these items are now included in new office construction.

As relatively few new projects will be started over the next two years, most of the work will be for renovation of existing space. Most new office construction will be smaller projects in the suburbs and in the South and Southwest.

Conversion of hotel and retail space to office space is a small but significant portion of the construction landscape. Similarly, conversion of existing office space to hotel and multifamily units is also occurring.

Retail Construction

Retail establishments will continue to consolidate, as companies struggle with the shift in consumer demand amid a coronavirus environment. One of the interesting developments of late is online commercial sites experimenting with brick-and-mortar stores. Restaurants are still dealing with shifts in pandemic restrictions and shifts in consumer demand. This year and next year, restaurants and bars will provide opportunities for plumbing contractors as these establishments that haven’t already done so renovate their facilities to accommodate concerns about disease transmission and to meet local health standards. Quality HVAC systems that provide clean ventilation are indispensable. Touchless plumbing fixtures in bathrooms and in the kitchen are a necessity.

A small number of malls are being converted to residential properties, which provide opportunities for plumbing contractors; these are multi-year projects.

Lodging Construction

Most spending on lodging construction has been aimed at reducing the possibility of disease transmission in rooms and common areas to protect employees and customers. Leisure travel has been faster to improve than business travel. The latter is beginning to move upward, but remote meetings are cost effective in many cases and preferred to travel by many employees. Business conventions are being scheduled, but still below pre-pandemic levels. Attendance at most of these conventions is lower, with some opting for virtual attendance if offered.

For existing establishments that haven’t already upgraded their site, renovation is vital. This includes updating HVAC systems to improve air flow and reduce the likelihood of spreading disease. Plumbing fixtures in shared bathrooms must incorporate touchless technology. These features are also required in the few new properties that will be built this year and next. In some projects, amenities like fountains and swimming pools are included in both renovations and new construction.

Education Construction

Most schools have undertaken the easy/least costly renovations of existing space to deal with coronavirus-related health concerns. For some schools, there is still a need to install or upgrade HVAC systems to improve air flow and filtering. Also, touchless plumbing fixtures need to be installed in bathrooms and kitchens if that hasn’t been done yet. The Infrastructure Investment and Jobs Act, which was signed into law in November of last year, provides $200 million over five years for secondary schools for clean drinking water, with a particular focus on replacing lead pipes. Another $500 million is available for secondary schools and non-profits to improve energy efficiency (i.e., improved HVAC systems).

New construction of educational facilities will be slow to ramp up as tax revenues are restored by an improving economy and as a willingness to approve new bond issues for these projects by voters is revived. Even where there are the funds and the support for new projects, it takes time to get these plans underway. These projects need to incorporate high-quality HVAC systems with excellent airflow and filtration systems and touchless plumbing systems.

Healthcare Construction

The two features that are paramount for healthcare facilities are flexibility in configuring space and superior infection control. The requirements for safely treating coronavirus and the fluctuations in patient intake have resulted in a need for adaptable space that can easily and rapidly be reconfigured.

High-quality ventilation is essential. This includes filters that capture extremely high percentages of pathogens and systems that can be readily monitored and cleaned or replaced to maintain peak performance.

ICUs that can easily be expanded and contracted with the capability to produce negative air pressure in these rooms is crucial. Touchless plumbing fixtures are also vital. These features are most easily included in new facilities, but there is a great need to incorporate them in existing facilities.

President and Chief Economist