By Bernard Markstein, Ph.D.

The fallout from the COVID-19 pandemic and the policy response to offset its most serious impact on markets is still affecting the economy. In particular, inflation for much of 2022 ran higher and longer than policymakers expected. This was a result of supply chain problems and a shift in demand to more goods at the expense of demand for services stoked to some extent by the stimulus packages meant to prevent falling into a deep recession. The war in Ukraine disrupted food and energy supplies, further contributing to rising prices.

Concern over the high and persistent rate of inflation prompted the Federal Reserve to embark on a program of tightening monetary conditions by starting to raise interest rates in mid-March. The Fed raised the federal funds rate, which the Fed controls directly, from near 0% in early March to between 3.75% and 4% in November. Over that same March to November time frame, the 10-year Treasury bond rose from around 1.9% to around 4% and mortgage rates more than doubled. Meanwhile, Fed Chair Powell has indicated that further increases in interest rates lie ahead.

Higher interest rates have fallen heavily on the housing market. The single-family market has felt most of the pain. Both single-family permits and starts declined from February through October. Starting in July, single-family starts fell below one million starts at a seasonally adjusted annual rate (SAAR). This is well below the minimum long-term need for single-family housing starts of 1.2 million per year. Still higher interest rates will act as a further drag on this market and even fewer starts.

For the overall economy, there is a considerable likelihood of a recession beginning in the first half of 2023—roughly an 85% chance. However, given the strength of both household and business balance sheets, there is high probability that the recession will be fairly mild and a slim possibility that there will not be a recession—the fabled soft landing.

What’s up with employment?

In the first two quarters of the year, real (inflation-adjusted) gross domestic product fell 1.6% and 0.6%, respectively. Normally, two back-to-back quarters of negative GDP growth would indicate that the economy had fallen into recession. This is not a hard and fast rule, but a strong indicator that did not apply this time. Real GDP snapped back in the third quarter, up 2.9%.

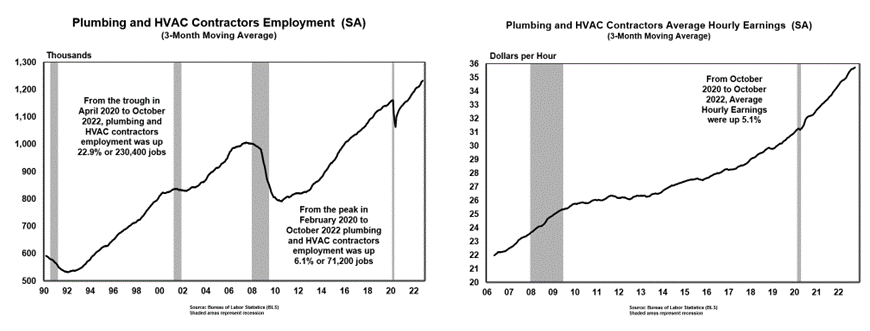

Plumbing and HVAC contractors employment ended up taking a different path. Employment for this sector peaked pre-pandemic in February 2020 at 1.17 million jobs. After an initial drop in March and April of 2020, it began to recover. By a year and a half later, in August 2021, employment exceeded its pre-pandemic peak. As of December 2021, the sector had 1.19 million jobs, 2.2% above its pre-pandemic peak. Further, average hourly earnings increased from its February 2020 pre-pandemic peak of $31.35 an hour to $34.35 in December 2021, a jump of 9.6%.

Seasonally adjusted (SA) nonfarm payroll employment has grown every month since the end of 2020. From January 2021 through November 2022, SA employment grew an average of 392,000 per month. November’s SA employment increase was a lower, but still strong, 263,000.

From March through November 2022, seasonally adjusted construction employment was above its February 2020 pre-pandemic peak (7,624,000) except for a slight dip in April (1,000 under its pre-pandemic peak). As of November, it was 126,000 greater than its pre-pandemic peak.

In November 2022, the national unemployment rate stood at 3.7%, near its recent and pre-pandemic low of 3.5%. For now, the strength in the labor market is evidence that a recession has yet to begin. However, as the effects of higher interest rates work their way through the economy, employment gains will slow, and if a recession ensues, will become employment losses accompanied by a rising unemployment rate.

Plumbing and HVAC contractors employment’s pre-pandemic peak was also in February 2020 at 1.17 million jobs. After an initial drop in March and April of 2020, it began to recover. Unlike national or construction employment, Plumbing and HVAC contractors employment exceeded its pre-pandemic peak much earlier—in August 2021. As of October 2022, the sector had 1.24 million jobs, 6.1% above its pre-pandemic peak. Further, average hourly earnings increased from its February 2020 pre-pandemic peak of $31.35 an hour to $35.89 in October 2022, a jump of 14.5%.

Construction Outlook

Fallout from the pandemic continues to plague the construction industry. The pandemic exacerbated the shortage of skilled labor in construction and was a prime factor in disrupting the supply chain, driving building materials prices higher. The rapid rise in remote work encouraged movement to lower cost areas and a desire for more space, whether in an apartment or in a house. Accompanied by low interest rates and the influx of funds from stimulus payments, demand for single-family houses and larger multifamily units increased.

In 2020 and 2021, it was residential construction activity that did well. In 2020, it was spending on residential improvements that grew the most, with multifamily and single-family construction spending pulling up a respectable second and third, respectively. In 2021, it was single-family construction spending leading the way followed by residential improvements, with multifamily spending growing but not as rapidly as the other two. Both single-family and multifamily construction slowed considerably in 2022 as higher interest rates hit home. Spending on improvements turned in robust growth, easily exceeding construction cost increases.

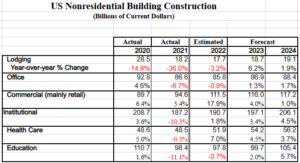

Nonresidential construction struggled in 2020 and 2021. Lodging construction activity fell in both years. Office construction activity was only a bit better, advancing a bit in 2020, but then falling in 2021. Retail construction activity was largely supported by construction of warehouse space to meet the rising demand for home delivery of various goods and, to a lesser extent, by the need to renovate older retail space—mainly ageing malls.

Construction activity for education buildings was generally down. Construction of healthcare facilities was rose in 2020 but then fell in 2021.

Residential construction activity was strong enough to power total construction spending higher in 2020 and 2021. Total current dollar construction spending rose in 2022 due more to higher input costs than increased activity.

On the positive side, supply chain issues have been improving though they are not completely resolved. However, the war in Ukraine has created disruption of world energy supplies. Crude oil prices rose above $120 a barrel in June, but more recently have fallen into the $80 to $90 a barrel range. Oil prices remain high, but are now below levels experienced from first quarter 2011 through third quarter 2014.

Residential Construction

Many employers have sought the return of their workers to the office. Pushback by employees has delayed that return or, in some cases, led to an acceptance of hybrid work (some time spent in the office and the rest of the time employees working remotely) by employers. The acceptance of remote work at least part of the time has allowed people who during the pandemic moved from center city locations to suburban locations or to other, smaller cities to continue to live in their new location.

Many of the people who relocated moved from high price areas to lower price areas. For those who sold a house in the high price area, they were able to outbid others in the new area, driving housing prices higher. The higher housing prices propelled single-family construction higher. Higher housing prices helped push up rental rates for both single-family houses and multifamily units (i.e., apartments). This increased the profitability of multifamily projects, leading to more such projects. For those homeowners who were now working from home and either chose not to move or felt they could not afford to move, they often decided to “fix up” their current house, spurring spending on home improvements.

Building materials price inflation and shortages of construction labor (particularly skilled labor) acted as a drag on all three areas of residential construction. Higher house prices and historically low supply of for sale housing inventory were a drag on demand for both new and existing homes. Now, since the Fed started raising interest rates resulting in a more than doubling of mortgage rates since the beginning of 2022, even more potential buyers are being priced out of the housing market.

Single-family housing construction will continue to decline as rising mortgage rates further deter demand for new and existing homes. In the near term, there will still be many projects that require installation or replacement of HVAC systems as well as plumbing systems as builders work on their backlog of houses under construction as well as those recently started or about to be started, though the number of these is declining.

Around the middle of 2023, the Fed is likely stop raising interest rates. At that point it will pause for several months to assess the impact of higher rates on inflation, which we expect will be clearly falling towards an acceptable level. With inflation largely under control, in 2024 the Fed will begin to slowly lower its target federal funds rate in 25 basis point increments over a number of months. The result for single-family housing demand will be a bottoming of housing starts in late 2023/early 2024 and slow improvement throughout 2024.

Some homeowners who would like to purchase a larger new or existing home that better meets their needs but do not believe they can afford to do so under prevailing interest rates and also may be reluctant to give up their current low interest mortgage loan will turn to undertaking an upgrade of their house. For some of these people that will mean a new kitchen, adding a bathroom, adding air conditioning to their home (this will be particularly true for parts of the country that traditionally have not had nor needed AC but are facing hotter summers due to climate change), or replacing or upgrading their current HVAC system. Also, in many parts of the West that continue to face drought conditions, many homeowners and landlords will want to repair/replace older pipes that leak water and install water saving devices.

For those who do not already own a home and are priced out of the housing market, they must either live with family or friends or rent a place to live (possibly with roommates). Thus, the demand for rental units (both single-family and multifamily units) will remain high. This will support build for rent and multifamily projects over the 2023 and 2024 period, though at a lower level. All of these projects will require installation of HVAC systems as well as plumbing.

Proper air flow and ease of maintenance will continue to be a high priority for HVAC systems installed in both single-family and multifamily units. Also, plumbing fixtures utilizing touchless technology will continue to be a requirement for shared bathrooms and other common areas (e.g., shared kitchens) for multifamily projects.

There is also the small but significant movement to convert retail (primarily malls), lodging, and office space to residential space. These projects require extensive reconfiguring/replacement and installation of both plumbing and HVAC systems over a long period of time. These projects tend to be expensive, which limits their adoption in more than a few cases, but can provide a significant opportunity for the plumbing and heating contractor who secures that business.

Office Construction

The demand for office space has been adversely affected by fallout from the pandemic. The acceptance of many companies of remote work and the rise of the hybrid model that incorporates a mix of in-office and remote work has reduced demand for office space. Most financial services companies are now requiring employees return to the office most if not all of the work week. Companies that have embraced the hybrid model still need some office space for when workers are needed or required to be in the office. Companies that no longer need all the space they are currently leasing frequently sub-lease their excess space, adding further downward pressure on the need for new office buildings.

In the 2023 and 2024, there will be few new large projects. There will be some limited demand for renovation of existing space. Most new office construction will be smaller projects in the suburbs and in the South and Southwest. This may prove to be an opportunity for plumbing and heating contractors as there will be many small projects requiring the installation of plumbing and HVAC systems rather than large systems in big office buildings.

Beyond that, existing office buildings still require normal inspection and maintenance of their HVAC and plumbing systems.

Conversion of hotel and retail space to office space (the opposite of the conversion of office space to residential space), is a small but significant portion of the construction landscape. Again, these projects can provide the plumbing and heating contractor a good amount of work for a single project.

Retail Construction

Over half of the growth in retail construction spending has been due to warehouse construction. New bars and restaurants have also been opening up, frequently taking over existing space from shuttered food service establishments. In these cases, major renovations often are needed. Another development is online commercial sites opening brick-and-mortar stores, again requiring updating existing HVAC and plumbing systems.

The outlook for commercial construction over the next two years is poor. Thus, there will be few opportunities for plumbing contractors in this area of construction. What opportunities that will arise will be for bars and restaurant which will require high quality HVAC systems that provide good ventilation with filters that capture most pathogens and pollutants. Also, there is the need for touchless plumbing fixtures in both the bathrooms and the kitchens.

As already noted, a few but growing number of malls are being converted to residential properties, which provide opportunities for plumbing contractors. These are multi-year projects.

Lodging Construction

Leisure travel has largely recovered while business travel is only slowly improving. The pandemic led to a reassessment of business travel by employers. Many companies have decided that remote meetings are cost effective in many situations and may even be preferred to travel by many employees. At the same time, business conventions and conferences, while up, are still below pre-pandemic levels. With the threat of a recession ahead, many businesses are reducing their 2023 travel budgets.

Most lodging establishments have already made whatever renovations they deemed necessary. With consolidation in the industry, few new hotels and motels are being built. Staffing shortages also limit the willingness of the various hotel and motel chains to build new facilities in the United States. Most of the spending over the next two years will be focused on repair and maintenance and renovation at the few places that have not updated their facilities in the past few years.

As previously noted, in limited cases existing office space is being converted to hotels and a few hotels are being converted to multifamily units. All of these projects require updating or replacing their HVAC system and plumbing.

Education Construction

Some schools have already updated their HVAC systems to deal with coronavirus-related health concerns. For various reasons, including lack of sufficient funding, other schools (mainly, but not exclusively, urban schools) still need to install or upgrade their HVAC systems to improve air flow and reduce the risk of spreading transmissible diseases. Also, touchless plumbing fixtures need to be installed in bathrooms and kitchens in many of these schools.

The Infrastructure Investment and Jobs Act passed in November 2021 provides $200 million over five years for secondary schools for clean drinking water, with a particular focus on replacing lead pipes. Another $500 million is available for secondary schools and non-profits to improve energy efficiency, which includes improving HVAC systems. Most of these funds have yet to reach local school districts, but more of this money will be flowing out in 2023 and 2022.

New construction of educational facilities will only slowly increase in 2024 and beyond as new bond issues for these projects are approved by voters. Part of the reason the rise in construction activity in this sector takes so long is that these big projects prove to be lengthy in the time required for planning, securing funding, and execution, as well as the requirement of competitive bidding on most of these projects.

Whether for new construction or for renovating or upgrading existing water and HVAC systems, there will eventually be plenty of work for plumbing and heating contractors, just not for a few years.

Healthcare Construction

The complexity and cost of building large healthcare centers (hospitals) has been a hinderance to new construction of these facilities in spite of the challenges and needs that emerged during the pandemic. The difficulty in properly staffing existing facilities has meant a greater reluctance to pursue these projects, or to at least slow the planning and execution of new construction of these facilities. Minute clinics and other smaller facilities in suburban areas have been where most of the spending has gone in recent years. In the case of minute clinics, often they can be set up in existing facilities with only minimal renovations.

For newly built facilities, high-quality ventilation is required. This includes filters that capture an extremely high percentage of pathogens and systems that can be readily monitored and cleaned with filters that can be easily replaced to maintain peak performance.

For hospitals with ICUs, those rooms have to be designed to be easily expanded and contracted with the capability of producing negative air pressure in these rooms. Touchless plumbing fixtures are also vital. These features are most easily included in new facilities, but there is a great need to incorporate them in existing facilities as well.

Funding and construction of new facilities will prove to be slow and limited in both 2023 and 2024.

Plumbing and HVAC Business Opportunities Moving Forward

The latest economic trends give p-h-c contractors an opportunity to identify where growth will occur and possibly shift their strategies. Such opportunities include:

- Indoor Air Quality

- Air Filters that are easy to clean or replace

- HVAC Air Ventilation that provides good outside air exchange with easy, low-cost maintenance

- Touchless Plumbing Technologies

- New bars and restaurants needing upgrades to existing systems

- Building Conversions, such as malls and office buildings to residential space

- Residential Renovations including installation of air conditioning systems in houses in parts of the country where air conditioning has not been needed but are now facing hotter and longer summers

- Upgrades to Educational Facilities’ water systems and HVAC systems

- Healthcare Facilities

President and Chief Economist